Surety Bonds For Local Business: Protecting Your Investment

Surety Bonds For Local Business: Protecting Your Investment

Blog Article

https://www.insurancejournal.com/magazines/mag-features/2021/12/06/644274.htm -Wilder Cline

Are you a small business proprietor looking to secure your financial investment? Look no further than surety bonds.

These effective devices serve as a safety net, making certain that you are not left high and dry in case of unexpected circumstances.

With contractor cost , you can rest simple understanding that your hard-earned cash is safeguarded.

So why take unneeded threats? Pick guaranty bonds and safeguard your business's future today.

The Fundamentals of Surety Bonds

You require to comprehend the essentials of surety bonds to safeguard your small business investment.

Surety bonds are a form of economic guarantee that ensures a celebration will accomplish their contractual responsibilities.

As a local business proprietor, you may be required to acquire a surety bond when participating in agreements or bidding on tasks.

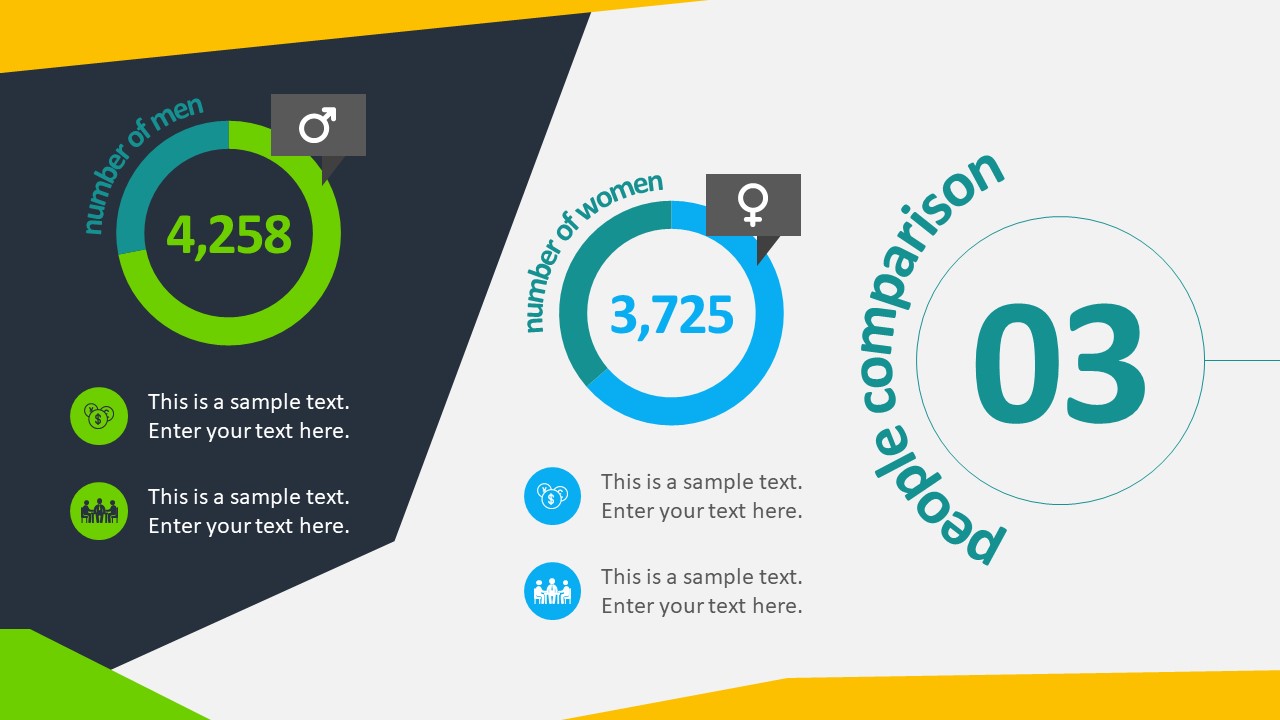

There are 3 major kinds of surety bonds: quote bonds, performance bonds, and settlement bonds.

Quote bonds assure that if you're awarded an agreement, you'll participate in the agreement and offer the essential efficiency and settlement bonds.

Performance bonds make sure that you'll finish the project as defined, while repayment bonds ensure that you'll pay subcontractors and suppliers.

Comprehending the Advantages of Surety Bonds

To completely understand the benefits of guaranty bonds for your small business financial investment, it is necessary to be aware of the protections they offer and the satisfaction they can supply.

Surety bonds act as a guarantee that your service will certainly fulfill its commitments to consumers, suppliers, and employees. This protection can be important in building count on and reputation with your stakeholders. In the event that your business stops working to provide on its promises, the guaranty bond makes certain that affected parties are compensated for any kind of financial losses sustained. This not just safeguards your financial investment yet likewise helps you prevent possible legal disagreements and reputational damage.

Additionally, surety bonds can offer you a competitive edge by demonstrating your dedication to professionalism and reliability and responsibility. By getting a surety bond, you reveal potential customers and companions that you're a reputable and credible service, which can lead to boosted opportunities and growth.

Tips for Picking the Right Guaranty Bond Supplier

When choosing a surety bond carrier, think about the following suggestions to guarantee you locate the right fit for your small business.

- ** Research study and Online Reputation: ** Beginning by looking into various guaranty bond providers and their online reputation in the industry. Look for carriers that have experience dealing with organizations comparable to yours and have a strong record of customer complete satisfaction.

- ** https://rowanqnhb50483.livebloggs.com/37474924/understanding-different-sorts-of-guaranty-bonds-and-their-uses : ** It is very important to choose a surety bond company that's solvent. Inspect the company's monetary ratings and see to it they have actually the capacity to satisfy their obligations in case of an insurance claim.

- ** Customer support: ** Excellent customer support is vital when dealing with guaranty bond service providers. Look for a provider that's receptive, knowledgeable, and ready to lead you through the process. This will make it less complicated for you to recognize the terms and conditions of the bond and address any kind of concerns that might arise.

Verdict

So, when it comes to securing your small company investment, guaranty bonds are a wise selection. They supply assurance and financial protection, making certain that you're shielded from any type of unexpected scenarios.

With the ideal surety bond supplier, you can with confidence browse business world, recognizing that your financial investment is secured.

Remember, a guaranty bond is like a guard, securing your company from potential dangers and allowing you to focus on development and success.